puerto rico tax break

When claiming a foreign tax credit you must complete Form 1116 Foreign Tax Credit. The zero tax rate covers both short-term and long-term capital gains.

Crypto Rich Are Moving To Puerto Rico World S New Luxury Tax Haven Bloomberg

Impuesto a las Ventas y Uso IVU is the combined sales and use tax applied to most sales in Puerto Rico.

. It confers a 100 tax holiday on passive income and capital gains for 20 years. Territory also has crypto-friendly policies including huge tax breaks to those who spend. The tax breaks fall under a law known as Act 60 a version of which was initially enacted by the Puerto Rico government under another name in 2012 as the island faced a looming economic collapse.

Salvador Casellas a federal judge and former treasury secretary of Puerto Rico was a leader in lobbying for manufacturing tax breaks in the 1970s during a crisis that echoes. The government says Puerto Rico needs the. Learn More At AARP.

Theres also no capital gains tax. HISTORY OF CRISIS. 6 Often Overlooked Tax Breaks You Wouldnt Want To Miss.

You have to move to Puerto Rico to qualify. Beyond the fact that Puerto Rico offers a year-round tropical backdrop with picturesque beaches the US. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund.

856 for more information about the foreign tax credit. Known as Act 60 previously Acts 20 and 22 Americans who move a qualifying business to Puerto Rico including becoming a Bona Fide. Act 20 is for companies.

The Puerto Rico Sales and Use Tax SUT Spanish. The IRS have begun auditing individuals who moved to Puerto Rico to take advantage of the tax incentives that began in 2012. During the period of 2012-2019 more than 4000 individuals and businesses moved to Puerto Rico.

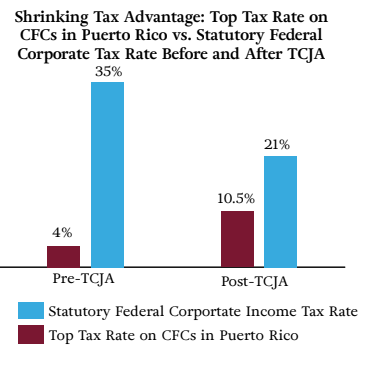

1 the 4 corporate tax rate has existed for decades and lasts potentially decades into the future. It is possible to. The incentive drew more interest after 2017 when Hurricane Maria decimated the island.

As of 2020 the tax rate is 115. In 1996 President Bill Clinton signed the law that would phase out. Ad We file Puerto Rican Hacienda US and Canadian returns.

Current temperature in Puerto Rico 85 F. The tax break also had some unintended consequences notably the unfair tax burden that fell to domestic Puerto Rican companies. In 2019 the tax breaks were repackaged to attract finance.

Still Puerto Rico hopes to lure American mainlanders with an income tax of only 4. It gives owners of incented new Puerto Rican companies a 34 tax on dividended income. If you move to the island you can legally pay none.

17 hours agoMove to Puerto Rico. That trend of moving to Puerto Rico for tax incentives has continued even during the pandemic and the number of New York residents relocating to Puerto Rico has quadrupled compared to 2019. To calculate your foreign tax credit you must reduce the income taxes paid to Puerto Rico by any amount of income taxes allocable to excluded Puerto Rican source income.

Legally avoiding the 37 federal rate and the 133 California or. Sales and Use Tax. Furthermore as an added incentive Puerto Rico has a tax break program for American entrepreneurs who move to Puerto Rico and establish a business in Puerto Rico that provides services outside the territory.

Relative to the Made-In-America tax break the Made-in-Puerto Rico tax break has significant advantages. Act 22 is for individuals. Between March 2020 and February 2021 approximately 82 requests for a permanent move to Puerto Rico were filed by Manhattan residents.

Still Puerto Rico hopes to lure American mainlanders with an income tax. The previous year. The tax breaks fall under a law known as Act 60 a version of which was initially enacted by the Puerto Rico government under another name in 2012 as.

Lots of Sharks in These Waters. If you stay in Puerto Rico for 19 years and Act 60 sticks around youll get the 0 rate on 50 of your gain. The incentives were intended to lure high net-worth individuals and businesses particularly crypto investors.

Act 20 and 22 tax incentives have been replaced by Act 60 as of January 1 2020. And 2 the tax rate is for goods and services produced in PR and sold anywhere in the world including in the US. A growing number of wealthy outsiders are moving to Puerto Rico to take advantage of the islands tax breaks.

10 of the tax collected goes to the municipality where the sale was executed there are 78 municipios - municipalities and 105 of. You just have to give. Any time a new tax reduction strategy comes along you can bet the sharks will start circling looking for weaknesses and ways to make things easier.

In many if not most cases you must file taxes in two places with the IRS and with the Puerto Rico Department of Finance. Rodriguez for The New York Times.

Puerto Rico Taxes How To Benefit From Incredible Tax Incentives Global Expat Advisors

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

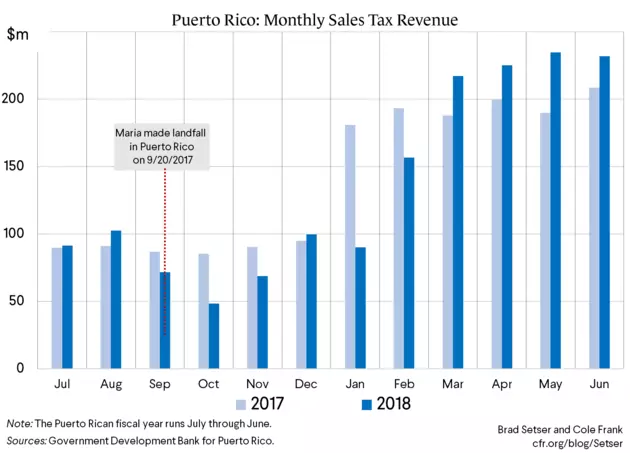

Looking Back On Fiscal 2018 As Puerto Rico Starts A New Fiscal Year Council On Foreign Relations

Puerto Rico Tax Haven Is Alluring But Are There Tax Risks

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Irs To Ultra Rich Looking To Dodge Taxes In Puerto Rico We Re Waiting For You Repeating Islands

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Tax Breaks For Crypto Millionaires Stir Outrage In Puerto Rico As Housing Surges Bloomberg

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Us Tax Filing And Advantages For Americans Living In Puerto Rico

![]()

Taxation Puerto Rico Move To Puerto Rico And Pay No Capital Gains Tax

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Crypto Rich Are Moving To Puerto Rico World S New Luxury Tax Haven Bloomberg

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

Federal Covid 19 Emergency Paid Leave Rules Apply In Puerto Rico But With Unique Tax Aspects Ogletree Deakins